This afternoon on its European Blog Google’s General Counsel Kent Walker exposed the full text of the company’s third-proposed and tentatively accepted antitrust settlement agreement with European Competition Commissioner Joaquin Almunia. Almunia previously declined to make the full agreement available.

The document, dated January 31, 2014, is quite long (embedded below) and contains extensive examples of how search results will look in Europe under the new agreement. There are the four areas that will see change or modifications, as summarized by Walker in his post:

- Changes to our AdSense terms to make it even easier for publishers to place ads on their sites from multiple providers;

- Changes to our AdWords API terms to make it even easier for software providers to build tools for advertisers to manage campaigns across platforms;

- New rules regarding how we will use website content in vertical search services; and

- Changes to our UI that will give rival services significant prominence (and valuable screen space) on our search results pages.

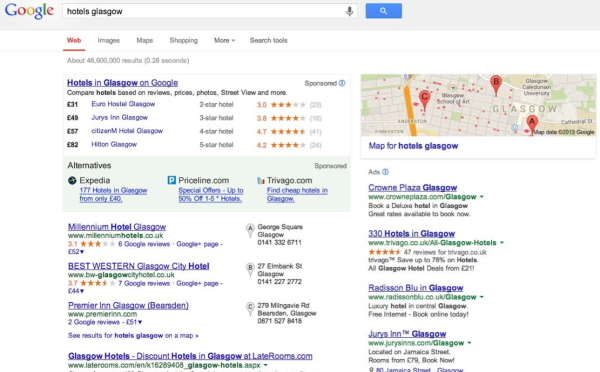

The screenshot below is taken from an appendix in the document. It reflects one presentation of alternative vertical results or “rival links,” here appearing under Google’s hotel results.

Source: Google

The rival links provision of the agreement was the most contested aspect of the settlement. Objections to the prominence and visual presentation of the rival links derailed Google’s two previous settlement proposals.

Google opponents such as FairSearch.org remain quite critical of the new agreement and want the EU to allow another “market test” (extensive evaluation of the proposal). Previous market tests resulted in calls for further modifications.

Three rival links will appear in prominent positions in organic results or in sponsored results. The document contains detailed discussion of when and where they will appear, which sites and publishers can “apply” to be included and what practices might get publishers ousted. The criteria are fairly extensive.

Here are a few brief excerpts of those discussions:

For each category of Google Specialised Results Triggers subject to display of Rival Links, Google will create a pool of eligible Rival Vertical Search Sites (a “Vertical Sites Pool”). Google will use the process described below to select from the relevant Vertical Sites Pool three eligible and distinct sites for linking (or as many sites as qualify from this process, if fewer than three) . . .

For Vertical Site Pools serving the display of Rival Links under paragraph 3 of the Commitments, the applicant site’s domains must meet a minimum popularity threshold based on usage data from one of three alternative reputable data sources. Google will set this threshold based on Alexa, comScore, and NielsenNetratings ranking data or equivalent thresholds from alternative reputable data source. If Google applies the threshold based on Alexa, comScore, and NielsenNetratings ranking, a domain of the applicant site will qualify if it meets one of the following three conditions: [top 1,000 Alexa ranking or top 500 comScore or Nielsen ranking] . . .If a site admitted to Vertical Pools for Paid Rival Links engages at any point in the harmful practices set out in Section II.B.(e), or violates the quality principles set out in paragraphs 15(d) below, Google may take one of the following measures: It may block non-compliant Paid Rival Links of the site in question from display. It may remove the site from Vertical Site Pools. . .

As indicated, some rival links will be free and some paid. For paid rival links Google will run an auction separate from AdWords. Here’s another excerpt from the agreement discussing the bidding and selection process:

For each instance that triggers an obligation to display Rival Links, Google will select up to three Rival Vertical Search Sites from the set of sites within the appropriate Vertical Sites Pool that have submitted a bid for the relevant keyword. For the purpose of selecting and ranking these sites, Google will multiply the sites’ bids and the relevant position-independent predicted click-through-rate (“pCTR”). Accordingly, as in AdWords auctions, the winning bids will not necessarily be the bidders with the highest cost-per-click bids. If several of the winning bids are from the same bidder or link to the same site, then Google may de-duplicate the Rival Links by exchanging the lower ranked duplicate Rival Link with the next ranked, non-duplicate Rival Link.

There’s much more discussion of how the auction will work and what content will be permitted. Conceptually it’s very similar to AdWords with some externally imposed constraints on pricing/bidding.

Source: searchengineland.com

Source: searchengineland.com